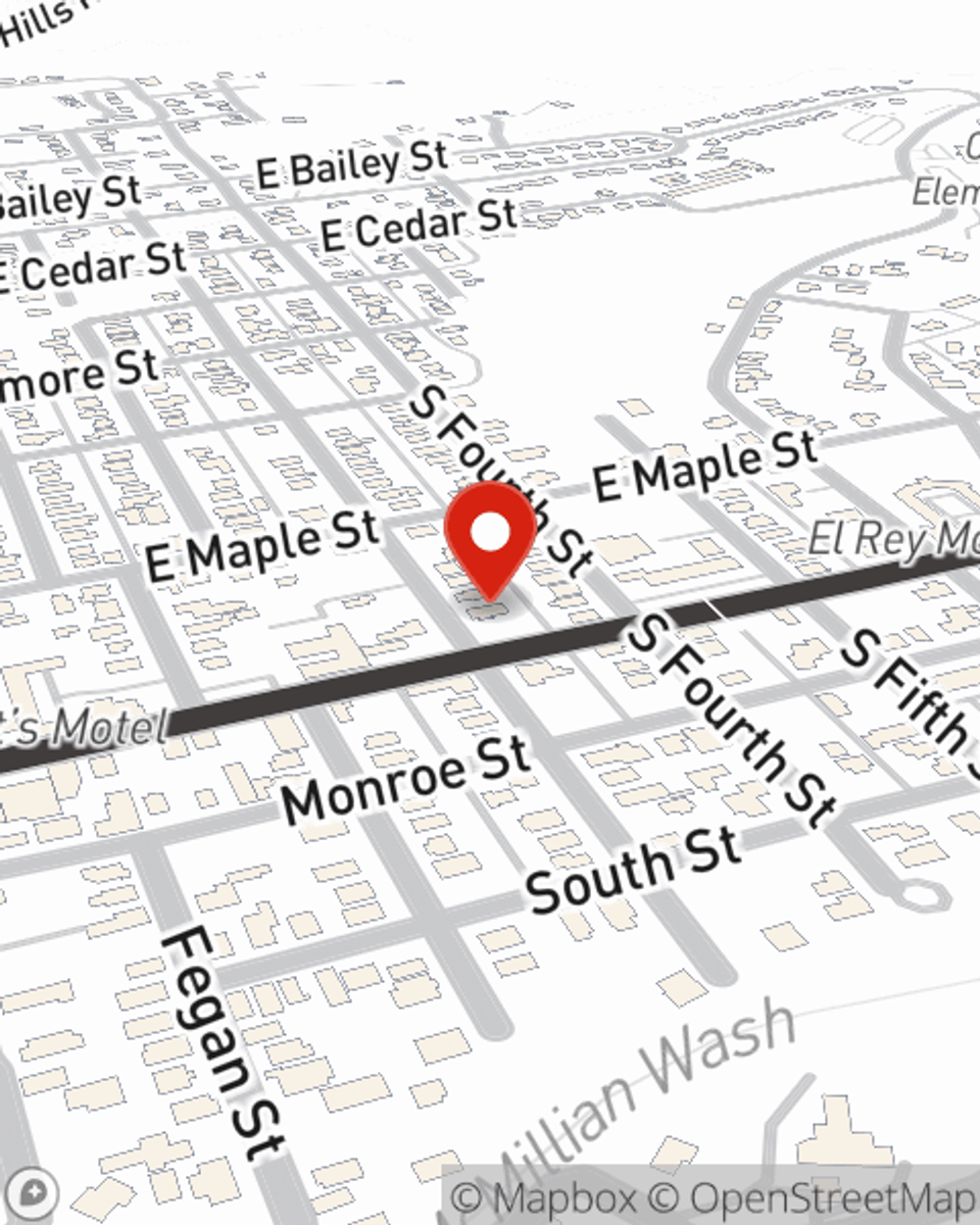

Business Insurance in and around Globe

Calling all small business owners of Globe!

Cover all the bases for your small business

Business Insurance At A Great Value!

Running a small business requires much from you. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, retailers and more!

Calling all small business owners of Globe!

Cover all the bases for your small business

Small Business Insurance You Can Count On

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Cami Lucero. With an agent like Cami Lucero, your coverage can include great options, such as artisan and service contractors, commercial auto and business owners policies.

As a small business owner as well, agent Cami Lucero understands that there is a lot on your plate. Visit Cami Lucero today to discover your options.

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Cami Lucero

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.